Peer to peer lending no credit check

Our peer-to-peer loans allow people of all credit histories to get access to the funds they need. Heres how the process works.

9 Things Borrowers Should Watch Out For Lendingtree

Heres how the process.

. It connects investors looking for high returns with creditworthy borrowers looking for loan. Online P2P Personal Lending and P2P Personal Loan sites are currently allowing people to connect with one another to get loans online - with real money and in real time. We compared and reviewed the best peer-to-peer lenders based on loan rates fees required credit score and more.

We offer assignment help on any course. This means that a personal loan through Prosper comes from traditional investors and a unique group of real people choosing to invest in YOU. Those with marginal credit should try to boost their scores even by as little as 30 points before taking out an installment loan with no credit check.

HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. Peer-to-peer lending is a form of direct lending of money to individuals or businesses without an official financial institution participating as an intermediary in the deal. Peer-to-peer loans are exposed to high credit.

This ensures all instructions have been followed and the work submitted is original and non-plagiarized. Apply Peer-to-peer P2P loan or Lend your money online on Indias best P2P lending marketplace IndiaMoneyMart. The money goes straight to your bank account through direct peer to peer credit.

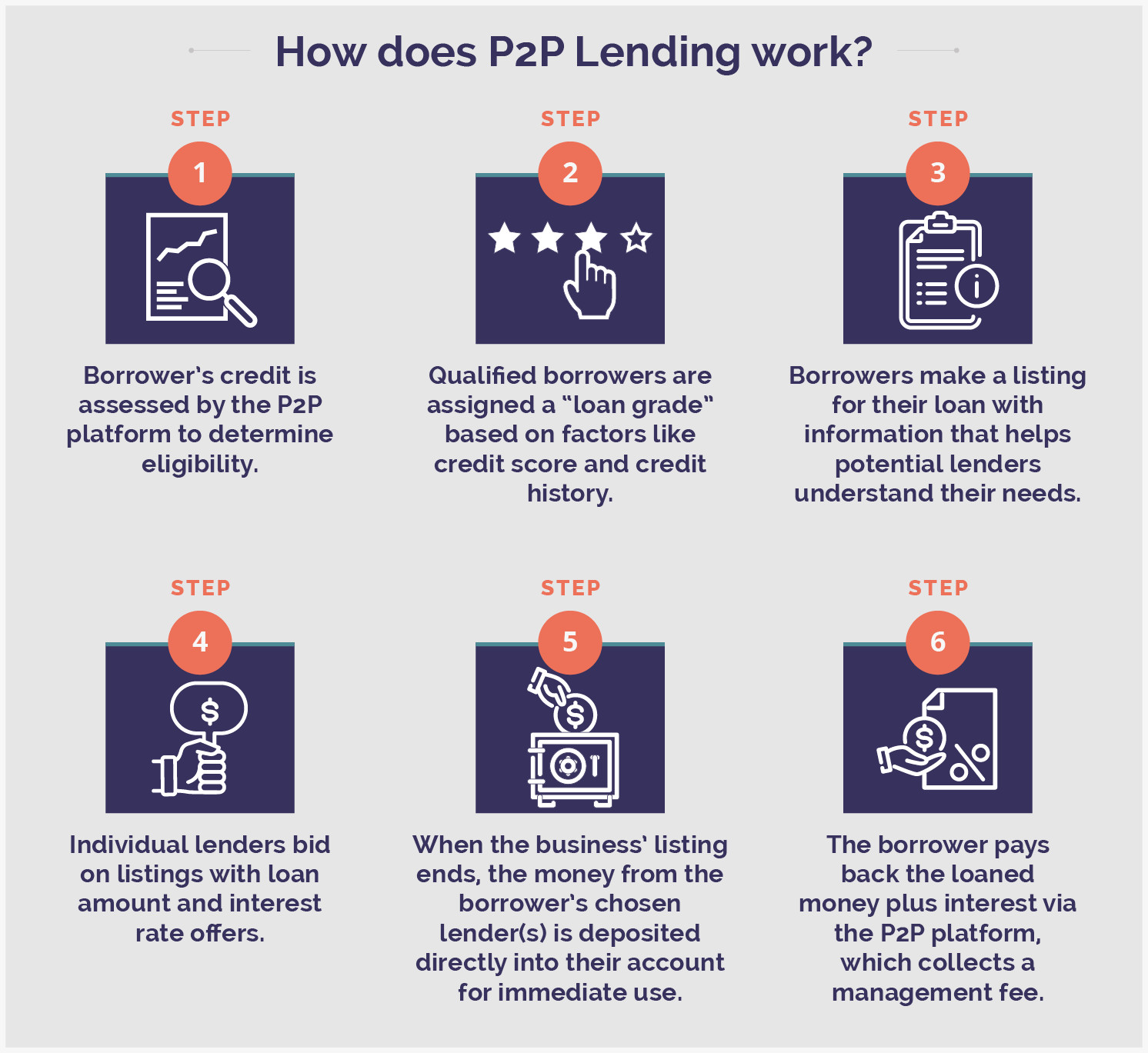

P2P lending is generally done through online platforms that match lenders with the potential borrowers. This ensures all instructions have been followed and the work submitted is original and non-plagiarized. Investors-Our platform offers global investors the opportunity to earn attractive returns by directly investing in strong creditworthy businesses via peer to peer lending.

No matter what type of loan you choose always make sure that you understand all of your financial responsibilities before you sign on the dotted line. Every investment comes with some amount of risk and peer-to-peer lending is no exception. From better ROI to more security the best peer-to-peer lending sites can help you meet your goals.

Prosper was founded in 2005 and was the first peer-to-peer lending marketplace in the United States. Peer to peer lenders who suffer bad debts on peer to peer loans from 6 April 2016 and relief conditions are met may also set these bad debts against interest received on other peer to peer loans. As weve warned it ISNT covered by the UK savings safety net which protects bank building society and credit union savings up to 85k per person per institution if.

A ridesharing company also known as a transportation network company ride-hailing service. LenDenClub is the largest Peer-to-Peer Lending Platform in India. All P2P NBFC loan projects at RupeeCircle undergo stringent credit analysis including CIBIL- check as well as physical verifications so that a diverse range of robust loan.

Choosing the right peer to peer lending sites is crucial if you want to invest your money safely and earn a good return. When you lend money to individuals you risk them defaulting. Peer-to-peer loans are funded by individual and institutional investors.

Check Eligibility Learn More. Before you use your cards check your available line of credit and your monthly interest rate. Peer-to-peer P2P lending looks like savings but with higher interest eg 5 acts like savings but smells like investing.

Peer-to-peer lending sites dont come with FDIC insurance like a CD or saving account. P2P personal loans are offered directly to individuals without the intermediation of a bank or traditional financial institution. It includes the shared creation production distribution trade and consumption of.

We offer assignment help in more than 80 courses. It is easily one of the most popular and trusted peer-to-peer lending platforms in the US. To learn more about.

2000 - 40000 Enter from 2000 - 40000. The vehicles are called app-taxis or e-taxis is a company that via websites and mobile apps matches passengers with drivers of vehicles for hire that unlike taxicabs cannot legally be hailed from the street. We offer assignment help on any course.

Peer-to-peer lending is a special option that comes with its own requirements terms and conditions. We have an essay service that includes plagiarism check and proofreading which is done within your assignment deadline with us. It often involves a way of purchasing goods and services that differs from the traditional business model of companies hiring employees to produce products to sell to consumers.

Customers can apply to borrow 100 to repaid over 4 to 6 months in equal repayments. However lenders sometimes include extra charges. P2P Credit offers personal loan access up to 40000.

Here are some of the best no-credit-check loans that wont hugely impact your credit score. Now avail personal loans even with bad credit scores Indian Individuals and corporate lenders can lend money online to eligible borrowers and earn high returns on Investments on this lending platform. Getting a no-credit-check loan with CashUSA involves no fees which is an important fact to have in mind when youre looking for an urgent financial fix.

The Prosper Credit Card is an unsecured credit card issued by Coastal Community Bank member FDIC. We have an essay service that includes plagiarism check and proofreading which is done within your assignment deadline with us. Our flexible terms mean that there are no late fees and we will always work with our customers to minimise default or bad debts.

Best Payday Loans Online No Credit Check Instant Approval. Prosper is the FIRST peer-to-peer personal loan lending platform in the US. Peer-to-peer loans lack the same liquidity that youd find in stocks or bonds.

Checking your rate wont affect your credit score. Finally get the funds in no time with peer to peer business lending at RupeeCircle. If your credit score falls into the 580 - 600 range you might have to apply for a no credit check payday loan.

In capitalism the sharing economy is a socio-economic system built around the sharing of resources. From the borrowers perspective peer-to-peer lending looks a lot like applying for a personal loan or some other type of financing. In this guide I ranked and reviewed the 7 best peer-to-peer lending sites so that you can pick the best one for you.

We offer assignment help in more than 80 courses. The legality of ridesharing companies by jurisdiction varies. Prosper has facilitated more than 21 billion in loans to over 13M people.

Our automated simple-to-use transparent and hassle-free P2P Lending Platform ensures that the borrowing needs of salaried individuals are met quickly and efficiently. Our Term Finance offering allows investors to earn 10 average ARR and Working Capital Finance is a great way to make short term investments. People who have marginal credit should consider doing everything possible to raise their score before attempting an installment loan with no credit check.

What Is Peer To Peer Lending Here Are 5 Things To Know P2p Lending Peer To Peer Lending Social Finance

Pin On P2p Lending India Infographics

Peer To Peer Lending Guide To Business Finance Xero Ca

The Ultimate List Of Peer To Peer Lending Sites For 2020 In 2020 Lending Site Peer To Peer Lending Business Loans

Pin On P2p

6 Best Online Peer To Peer Loans For Bad Credit 2022 Badcredit Org

A Review Of The Best Peer Lending Websites For Bad Credit Don T Think That All Peer To Peer Lending Is The Same Some Sites Credit Repair Loan Improve Credit

What You Need To Know When Applying For A Personal Loan Infographic Peerform Peer To Peer Lending Blog Personal Loans How To Apply Peer To Peer Lending

Peer To Peer Lending Guide To Business Finance Xero Ca

Here Is Everything You Need To Know About Peer To Peer Lending Peer To Peer Lending Peer Social Finance

Personal Loan Apply Online Personal Loans Peer To Peer Lending Best Payday Loans

Top Options For Peer To Peer Business Lending Lantern By Sofi

How To Get A Personal Loan Personal Loans Loan Loan Lenders

Pin On Commercial Real Estate

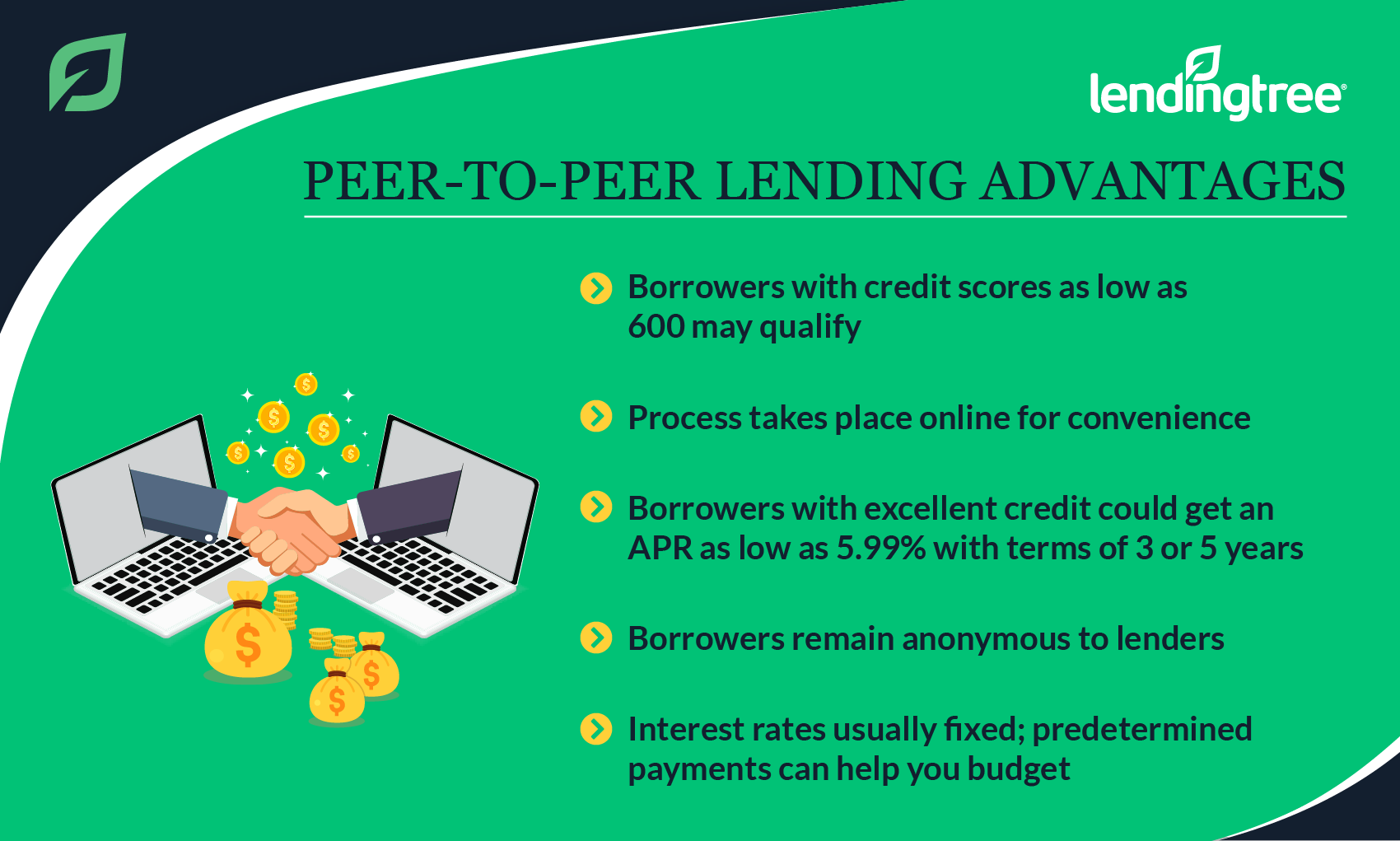

Peer To Peer Lending Types Advantages

Pin On Peer Finance Money Tips Personal Finance

This Board Talks About A New And Radical Investment Option Peer To Peer Lending In Order To Encourage The Inve Peer To Peer Lending Peer Investment Portfolio